At a Glance

Overview

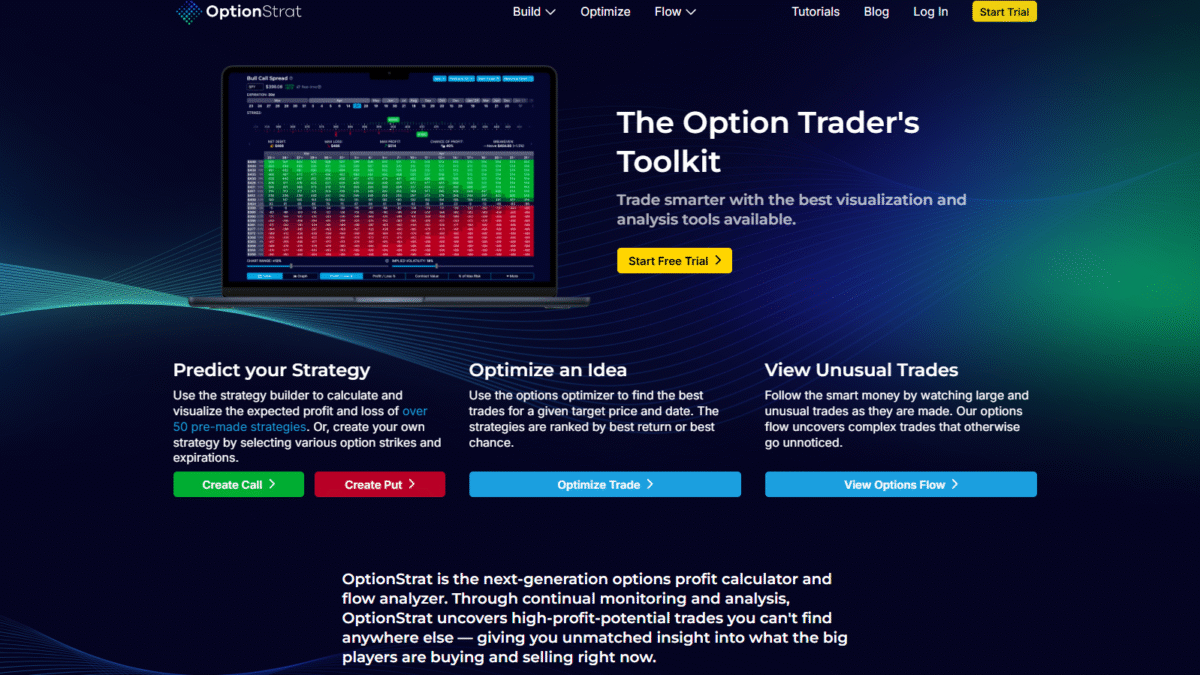

OptionStrat is the next‑generation options profit calculator and flow analyzer that puts powerful visualization and analysis tools at your fingertips. In just a few clicks you can model P/L curves, optimize multi‑leg strategies, and follow real‑time unusual options flow.

Ready to trade smarter? Keep reading to discover why OptionStrat could be your new go‑to option trading platform.

I’ve been in your shoes—juggling multiple tabs, spreadsheets, and half‑understood charts, trying to gauge potential profit, probability, and risk for every options trade. It’s overwhelming to piece together Greeks, P/L curves, and the latest institutional moves across a dozen tools. No wonder so many traders feel paralyzed or take hesitation before pulling the trigger.

That’s where OptionStrat shines. By combining a dynamic options profit calculator, a high‑speed strategy optimizer, and a live unusual options flow feed, it delivers actionable insights in one place. In this review, I’ll walk you through how the product tackles your biggest pain points—visualizing multi‑leg trades, scanning for top setups, and spotting “smart money” activity—so you can trade with clarity and confidence.

What is OptionStrat?

OptionStrat is a comprehensive option trading platform designed to help you build, optimize, and track strategies from a single dashboard. At its core you’ll find:

-

A Strategy Builder that lets you draw P/L curves, slide price and time, and visualize Greeks in real time.

-

A Strategy Optimizer that scans thousands of potential trades—ranked by probability or return—to find your ideal setup.

-

An Unusual Flow Analyzer that monitors OPRA data to alert you when institutions place large, aggressive orders.

Together, these modules give you a 360° view of the options market—no more hopping between apps or wrestling with manual calculations.

OptionStrat Overview

OptionStrat LLC was founded in November 2020 by Heath Milligan, a software engineer turned full‑time trader. What began as Heath’s personal project to visualize trade outcomes quickly gained traction among fellow options enthusiasts. The beta launched on November 1, 2020, and within months users were raving about the clear, interactive profit curves and the ability to spot large flow in real time.

By mid‑2021, OptionStrat opened its doors to the public, guided by four core principles: Clarity, Mastery, Time, and Community. Heath’s mission was simple—demystify complex options data, empower traders with actionable insights, and foster a collaborative environment where ideas and feedback flow freely.

Today, OptionStrat serves over 20,000 active users worldwide. From weekend learners to institutional strategists, its growth has been fueled by continuous improvements, responsive support, and a thriving Discord community where members share trade ideas and best practices.

Pros and Cons

Pros

All‑in‑One Toolkit: Combines **profit calculator**, **optimizer**, and **flow analyzer** in one seamless platform.

Real‑Time Data: Live options and underlying prices plus **unusual flow** alerts to follow institutional moves.

Powerful Visualization: Intuitive P/L curves, Greeks overlays, and probability distributions make strategy analysis straightforward.

Strategy Optimizer: Scans tens of thousands of trades by **option strategy** to find highest probability or highest return.

Custom Alerts & Filters: Save filters on flow criteria and get push notifications when matching trades occur.

Active Community & Tutorials: Access exclusive Discord chats, weekly video breakdowns, and in‑built tutorials.

Cons

Live Flow plan is pricier—may be a stretch for casual or part‑time traders.

No built‑in paper‑trading simulator—performance tracking is backtested, not executed with virtual capital.

Features

Before diving into the specifics, know that OptionStrat is built for option traders who want depth without complexity. Here’s what you’ll find inside:

Strategy Builder (Options Profit Calculator)

The heart of the product is its options profit calculator, letting you:

Select any multi‑leg trade or choose from 50+ pre‑made templates (covered calls, iron condor options, straddles, etc.)

Adjust underlying price, implied volatility, and days to expiration with sliders

View real‑time P/L curves, break‑even points, and max gain/loss

Overlay Greeks—delta, gamma, theta, and vega—directly on your chart

Strategy Optimizer

Stop manually scanning strikes—let the optimizer:

Ingest your target price, date, and risk tolerance

Scan thousands of combinations across expirations

Rank results by highest chance of profit or highest return

Highlight net Greeks and commission impact for each suggestion

Unusual Options Flow

Follow the smart money as it happens:

Monitors OPRA feeds for large, aggressive orders

Detects complex multi‑leg flow (spreads, condors, ratios)

Categorizes trades as bullish, bearish, or neutral

Save custom filters and receive web/mobile alerts

Performance Tracking & Backtesting

Keep tabs on your ideas:

Save strategies and view high/low/current value over time

Export P/L data for deeper analysis

Backtest against historical data to validate concepts

Market News & Events

Stay informed with:

Integrated earnings calendars, ex‑dividend dates, and market news

Alerts for upcoming catalysts that could move your trades

Probability Metrics & Greeks Dashboard

View your chance of profit percentage in both builder and optimizer

Chart net Greeks dynamically as you tweak your strategy

Enhance or dampen implied volatility assumptions to test “what‑if” scenarios

Custom Filters & Alerts

Build filters on flow criteria: size, aggressiveness, ticker

Save named filter sets for quick reuse

Push notifications deliver matching trades instantly

Community & Educational Hub

Private Discord group for paid members

Weekly “Trade Idea” video breakdowns

Step‑by‑step in‑app tutorials and knowledge base articles

Futures Data Support

15‑minute delayed futures for ES, GC, BTC, 6E and more

Visualize futures option strategies alongside equities

Pricing

Whether you’re just exploring option trading strategies or chasing institutional flow, there’s a plan for you:

OptionStrat offers both free and paid tiers—pick the one that fits your trading style and budget.

| Plan | Monthly | Annual |

| Free | $0 | $0 |

| Live Tools | $25.00 | $299.99 (17% off) |

| Live Flow | $75.00 | $899.99 (17% off) |

Live Tools ($25.00/mo or $299.99/yr)

Ideal for traders who need:

-

Live prices (no lag) for stocks and options

-

Full access to Strategy Builder and Optimizer

-

Market events, newsfeed, and volume overlays

-

Probability metrics and net Greeks

-

Saved strategy tracking and commission settings

-

Private Discord access

Live Flow ($75.00/mo or $899.99/yr)

Perfect for pros chasing institutional moves:

-

Everything in Live Tools, plus…

-

Real‑time Unusual Options Flow (no delay)

-

Saved filters, alerts, and performance tracking on flow

-

Historical flow search (past days/weeks)

-

Congress & insider trades feed

Free Plan

Great for beginners:

-

15‑minute delayed data across all features

-

Limited access to Builder, Optimizer, and Flow

-

No cost to learn core option trading fundamentals

Best For:

OptionStrat’s flexibility makes it valuable across experience levels:

Beginners & Learners

If you’re just starting with puts and calls for beginners, the Free plan teaches you P/L modeling and basic Greeks. Visual templates remove the intimidation factor.

Intermediate & Active Traders

You’ll appreciate the Strategy Optimizer’s automated scans and the probability metrics for refining covered call strategy or butterfly spread setups.

Professional Traders & Advisors

Live Flow’s institutional alerts and backtesting tools give you an edge when managing multiple accounts or advising clients on high‑profit‑potential trades.

Key Takeaways

All‑in‑One Toolkit: Strategy Builder, Optimizer, and Flow Analyzer in one platform.

Real‑Time Insights: Live P/L, Greeks, and unusual flow for timely trade decisions.

Strategy Optimizer: Automatically scans for the highest‑probability and highest‑return setups.

Custom Alerts: Save filters on flow criteria and get instant notifications.

Learning Ecosystem: In‑app tutorials, weekly videos, and a vibrant Discord community.

Flexible Pricing: Free tier to learn, with paid plans as you scale up your trading needs.

Benefits

I believe OptionStrat delivers outstanding value because:

-

Consolidation: One platform replaces spreadsheets, scanners, and charting apps.

-

Speed: Instantly generate and evaluate trades—no more manual leg-by-leg analysis.

-

Clarity: Visual P/L curves and live flow alerts translate data into actionable insights.

-

Risk Management: Calculate max loss, break‑evens, and probabilities before you trade.

-

Learning Curve: Built‑in tutorials, video series, and community support accelerate your growth.

-

Scalability: Start free, upgrade to Tools, then Flow only when you need institutional‑grade data.

Customer Support

In my experience, OptionStrat’s support team is quick and attentive. Paid members can access a private Discord channel where the founders and power users jump in to answer questions, troubleshoot issues, and discuss advanced tactics. I’ve never waited more than a few hours for a response there.

For billing queries or technical hiccups—like connecting broker data—you can also reach out via email. Their FAQ section is comprehensive, covering everything from plan changes to feature walk‑throughs. Overall, the support channels feel personal and genuinely helpful.

External Reviews and Ratings

OptionStrat boasts a 4.6 / 5 average across 3,300+ user reviews, with praise for its accurate options profit calculator and intuitive interface. On third‑party forums, traders highlight how quickly they spotted and acted on unusual flow, boosting their edge. Professional educators even reference it when teaching strategy design.

A handful of critiques mention the Live Flow plan’s cost and wish for a built‑in paper‑trading mode. The team has addressed pricing feedback by offering a 7‑day trial on all paid plans and emphasizing the long‑term savings of annual billing. They’re also exploring a demo‑only mode—so keep an eye on upcoming releases.

Education Resources and Community

OptionStrat goes beyond software—it’s a learning ecosystem:

-

In‑App Tutorials: Step you through each tool the first time you use it.

-

Weekly Trade Idea Videos: Breakdown real flow events and strategy setups on YouTube.

-

Discord Community: Share your screenshots, ask for feedback, and swap filter recipes.

-

Blog Articles: Deep dives on topics like options backtesting software and volatility trading.

This vibrant community ensures you’re never trading alone—and every question finds an answer.

Alternatives

Thinkorswim by TD Ameritrade

-

Pricing: Free platform, no subscription fee.

-

Strengths: Robust paper‑trading simulator, integrated equities & futures, advanced charting.

-

Drawbacks: Steep learning curve, no standalone unusual flow analyzer, interface can feel cluttered.

FlowAlgo

-

Pricing: Starts at $149/mo for flow alerts.

-

Strengths: Granular order flow visualization, historical flow backtesting.

-

Drawbacks: Lacks profit calculator and strategy optimizer, higher entry cost, minimal community tutorials.

Conclusion

After weeks of modeling trades, scanning optimizations, and tracking institutional moves in OptionStrat, I can confidently say it’s one of the most polished option trading tools available. Whether you’re testing your first iron condor or monitoring multi‑leg blocks in real time, the clear visuals and powerful alerts give you an unmistakable edge. If you’re ready to streamline your workflow and trade smarter, give OptionStrat a try.